Recruiting metrics are an essential part of any data-driven recruitment and hiring strategy. However, a common pain point for many talent acquisition professionals is sorting through the sheer amount of metrics and data points — it can seem endless without the right strategy and structure in place.

In this guide, we’ll help you determine which metrics actually matter for your organization based on your goals and why collecting them can make a difference in your hiring outcomes. To ensure your hiring team leverages the right data, we’re breaking down the 12 most important recruiting metrics you should be tracking. But first, let’s look at what hiring metrics are and the role they play in acquiring top talent.

- What are hiring metrics?

- Why should you track talent acquisition metrics?

- 12 critical hiring metrics to track

- How to track important talent acquisition metrics

What are hiring metrics?

Hiring metrics, sometimes referred to as recruitment metrics or talent acquisition metrics, are a set of measurements or data points teams use to track, manage, and optimize an organization’s hiring process.

When used properly, these metrics help your hiring team evaluate and enhance your recruiting process, maximize the success of your hiring strategies, and determine whether you’re hiring the right talent for your company. You can also tie these metrics to your company’s recruiting matrix to ensure your hiring process is diverse, inclusive, and equitable for all candidates you engage.

What’s the difference between recruiting metrics and talent acquisition metrics?

Talent acquisition and recruitment, while similar, actually refer to different aspects of hiring. Here are how the two types of metrics differ:

- Recruiting metrics focus on more immediate hiring needs, such as filling vacancies

- Talent acquisition metrics focus on improving long-term hiring health and strategy

We’ll break down these metrics later on to help you understand what your organization should prioritize.

Why should you track talent acquisition metrics?

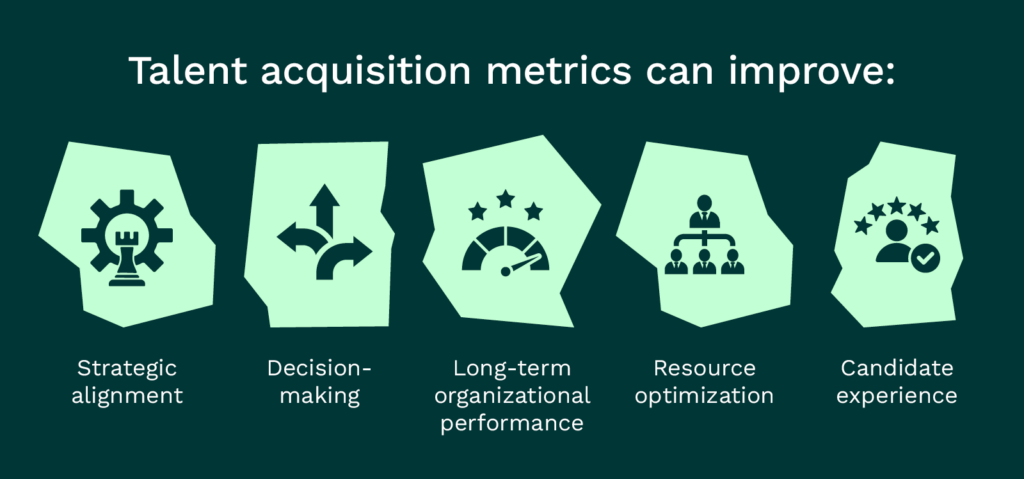

Implementing new tools and methods to track data can be a significant undertaking, but it’s well worth your while if you want to improve overall hiring success. Tracking talent acquisition metrics can help your organization with:

- Strategic alignment. It’s important to agree on organizational priorities across departments and roles. With comprehensive data metrics, you can easily identify and justify your priorities.

- Decision-making. As previously mentioned, there are many directions you can take with your talent acquisition strategy. Data is the most important tool you need to make informed decisions in the short- and long-term.

- Long-term organizational performance. Tracking critical talent acquisition metrics can help you measure the success of hiring decisions by looking at the employee lifetime value (i.e., quality and performance) of each employee you bring onboard.

- Resource optimization. Effectively allocating your budget and your team time to the most promising talent acquisition strategies is crucial for sustainable growth. Data-driven insights can point your team in the right direction.

- Candidate experience. Over half of all candidates drop out of the hiring process because they don’t feel engaged. Talent acquisition metrics can point to specific ways you can improve the candidate experience so you retain the best talent.

This list isn’t exhaustive by any means. That being said, understanding your past performance with sourcing, nurturing, interviewing and hiring can help you improve.

12 critical hiring metrics to track

Whether you’re just starting to measure your recruiting efforts or want to focus on tracking the most critical metrics that will help you optimize your hiring process, our list of a dozen key metrics is a great jumping-off point.

Recruiting metrics

1. Time to Fill

- What it is: Time to fill refers to the amount of time it takes from opening a new job requisition to candidate acceptance of an offer. Time to fill reveals how efficient the hiring process is. Factors such as industry demand or how quickly a hiring team operates can impact this metric.

- Why it matters: This metric helps recruiters and hiring managers better understand how long it usually takes them to fill open roles so they can create more accurate and timely recruitment plans.

2. Time to Hire

- What it is: Time to hire is the amount of time between when a candidate applies for a job and when they accept an offer. This metric shows how quickly a candidate moves through the various stages of hiring. Time to hire usually depends on the role type and your company’s respective recruiting process.

- Why it matters: A straightforward recruiting process can reduce time to hire, but roles that require multiple rounds of interviews, panel discussions, test projects, and other steps will drastically increase it. If you have immediate hiring needs, having a shorter time to hire will help you get results faster.

3. Cost per Hire

- What it is: Cost per hire is the total amount you spent on recruitment annually, divided by the total number of hires you’ve made.

- Why it matters: Understanding how much it costs you to hire for each role and where you spend funds can help you set budget-efficient goals and benchmarks.

4. Offer Acceptance Rate

- What it is: This metric lets you compare the number of candidates who accepted an offer versus the number of candidates who received an offer.

- Why it matters: Salary and compensation, benefits programs, flex work, and other factors can impact whether candidates accept or decline an offer of employment. A low offer acceptance rate often indicates a gap between your company and your competitors.

5. Applicants per Role

- What it is: Applicants per Role is the measure of how many applicants are applying for each open position.

- Why it matters: With this recruitment metric, you can determine your most popular job applications so you can replicate the sourcing or marketing strategies for other postings.

6. Source of Hire

- What it is: Source of hire is a measure of where candidates found your job posting. For example, some common channels include your careers page, external job boards, social media accounts, and any paid advertising channels.

- Why it matters: Knowing where your top candidates and applicants are coming from is invaluable, especially in your recruitment marketing. With this metric, you can track which sources and channels are driving the highest return on your investment (ROI) by attracting job seekers to your open roles and allocate resources accordingly.

Talent acquisition metrics

7. Candidate Diversity

- What it is: Candidate diversity refers to the variety of backgrounds, demographics, and experiences in your candidate pool. You can gather this data and measure this metric by leveraging resources like candidate surveys, hiring feedback, and more.

- Why it matters: Diverse teams are more innovative and are 87% more likely to make better decisions than homogenous ones, making it an important recruitment focus for any organization hoping to achieve their goals.

8. Attrition Rate

- What it is: Attrition rate is the rate at which your organization loses employees in any given time period. A common focus is first-year attrition (i.e., the number of employees to leave the company within 12 months of being hired).

- Why it matters: Constantly replacing top talent can be costly and time-consuming for talent teams. Tracking attrition rate helps you better discern the holes in your retention strategy, such as whether job descriptions and postings accurately communicate expectations and if hiring teams are being transparent during the recruiting process about roles and responsibilities.

9. Quality of Hire

- What it is: This metric refers to the overall performance and contributions of a new hire, typically within their first year. It considers factors like employee acclimation, hiring manager satisfaction, adjustment to the team and company culture, contributions to organizational goals, and any performance review outcomes.

- Why it matters: Poor hiring quality can cost companies up to 30% of the employee’s first-year earnings, so ensuring you’re paying attention to quality of hire is crucial.

10. Cost per Hire

- What it is: Cost per hire is the total amount you spend on recruitment annually, divided by the total number of hires you’ve made.

- Why it matters: Understanding how much it costs you to hire for each role and where you spend funds can help you set budget-efficient goals and benchmarks.

10. Number of Open Positions

- What it is: This metric is the number of open job positions you’re currently recruiting for.

- Why it matters: You can compare the number of open positions your company has to the total number of positions to determine the success of your hiring strategy. For instance, a lower number of open positions could indicate high demand, especially during periods of rapid growth or expansion. You can also look at this metric for specific departments or teams to pinpoint where you can improve your strategy.

11. Application Completion Rate

- What it is: This is the measure of how many people who start your application finish it.

- Why it matters: Tracking application completion rate can help you understand how streamlined your hiring process truly is. A drop in your application completion rate can indicate problems with this process and show you where you can streamline your recruitment funnel.

12. Sourcing Channel Effectiveness

- What it is: Sourcing channel effectiveness shows which specific job boards, social media sites, and career communities deliver the highest ROI for your recruiting efforts. It doesn’t necessarily measure sheer volume, like source of hire.

- Why it matters: Understanding which channels are most profitable can help guide your efforts based on efficiency.

How to track important talent acquisition metrics

Now that you better understand the different types of metrics you can focus on, it’s time to select the ones that make the most sense to track in your business. It’s important to note that not all organizations or teams track the same metrics or set the same key performance indicators (KPIs) for their talent teams.

For example, a hiring team for one functional business unit may be more concerned with signing on experienced developers who are more challenging to find, while another is interested in hiring less experienced marketing talent for more junior roles. This can lead them to prioritize different metrics, like quality of hire over time to fill.

With this in mind, you can start the process by setting talent acquisition benchmarks — the typical results by which you measure hiring effectiveness.

When setting the benchmarks you want to measure your performance against, look at your hiring team’s past performance. Ask yourself specific questions like:

- Did we meet our hiring goals compared to other quarters?

- Have we reduced the time and costs associated with hiring?

- Has our new hire attrition rate increased or decreased?

- How effective are our candidate sourcing channels?

- Have we seen any changes in offer acceptance rates?

Another crucial foundation of collecting hiring metrics is using the right recruitment technology. As the top applicant tracking system (ATS) for scaling companies, Lever can empower you to find, nurture, and hire the best talent easily and efficiently. Click here to see how Lever can help you better track hiring metrics and move your business forward.